What Nigeria’s New Tax Law Means for Freelancers, Remote Workers and How Myaza Helps You Stay Sharp

If you’re a freelancer, remote worker, or digital creative earning in dollars, pounds, or euros, there’s something you need to know. Nigeria’s tax laws have changed.

In June 2025, the government signed four major reform bills into law, the biggest tax overhaul in decades. From January 2026, the way you report and pay tax on your income will look very different.

The goal is simple: to make Nigeria’s tax system clearer, more digital, and more enforceable. But what does that mean for you and how can Myaza help you stay ahead? Let’s break it down.

How This Affects Freelancers and Remote Workers

If you work remotely from Nigeria and earn from clients abroad through platforms, like Upwork, Fiverr, Deel, or direct contracts, this law applies to you.

Here’s the summary:

You must register with your state tax authority.

You’re required to declare your foreign earnings in naira (using the official CBN rate).

You’ll pay Personal Income Tax based on your total yearly income.

And because most foreign inflows go through BVN-linked accounts or virtual dollar cards, it’s easier than ever for tax bodies to see what you earn.

But don’t panic, it’s not all bad news.

Key Tax Adjustments You Should Know

The first ₦800,000 of your annual income is tax-free.

Income above that amount is taxed progressively between 15% and 25%, depending on how much you earn.

If you receive a severance or termination payment, the first ₦50 million is exempt from tax.

Registered small businesses earning under ₦50 million annually are exempt from Company Income Tax (CIT).

For many freelancers, that means less tax pressure than before as long as you report correctly and plan smartly.

How Myaza Helps You Stay Compliant (and Stress-Free)

The new tax structure doesn’t have to feel scary. Myaza is built to help African freelancers, digital workers, and remote earners stay organized, compliant, and confident.

Here’s how:

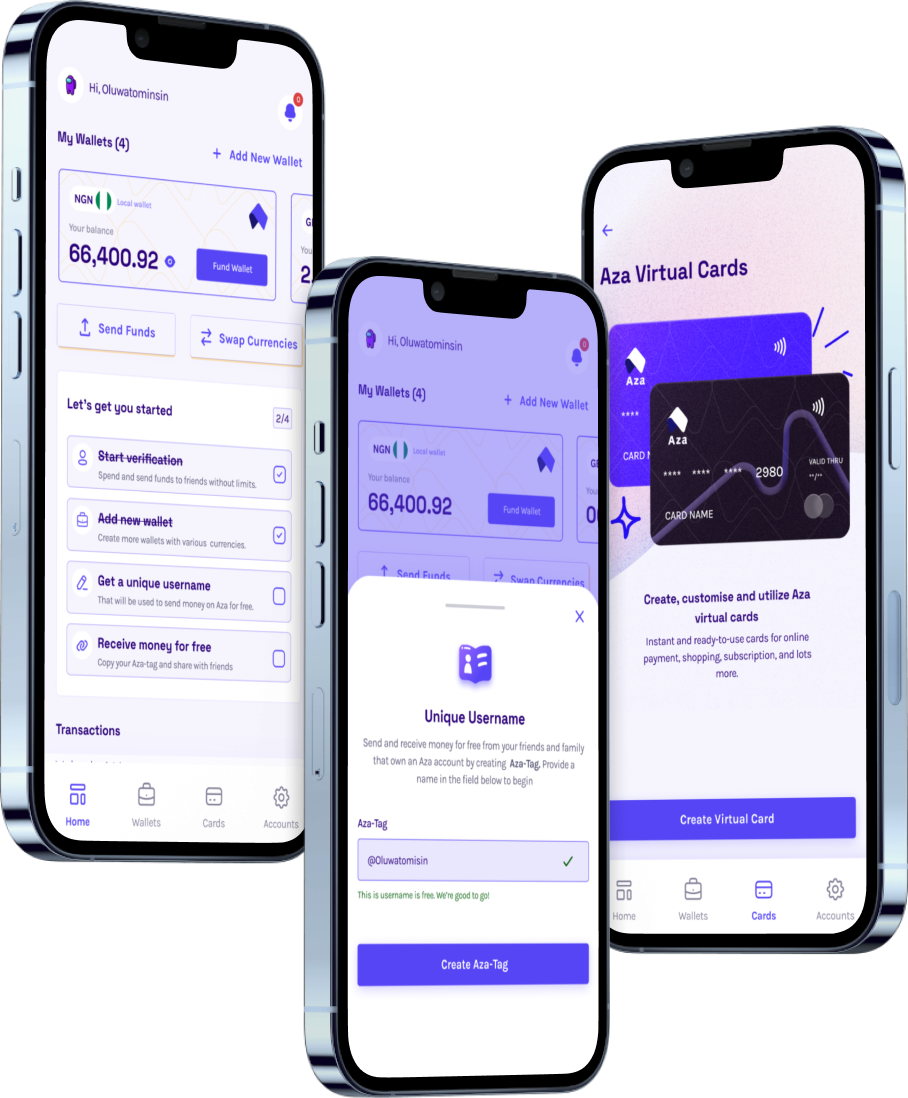

1. Track Your Income in Real Time

Myaza’s multi-currency wallets let you receive payments in USD and NGN, all in one place.

You can view your entire earning history, download statements, and keep clean records for your accountant or state tax office.

2. Convert Earnings at the Right Rate

Since the law says your taxable income must be calculated in naira using the official CBN rate, Myaza helps you stay updated.

You’ll always know the conversion value of your dollar or euro income when it’s time to file taxes.

3. Plan and Set Aside for Taxes

You can move funds across wallets or hold a set percentage of each earning in NGN as a “tax reserve.”

4. Transparency That Protects You

Every Myaza transaction is time-stamped, traceable, and exportable.

That means you can prove your income easily and protect yourself from over-taxation or wrong assumptions by tax bodies.

5. Stay Global, Stay Legal

Myaza makes it simple to earn and spend globally while staying compliant at home.

So you can focus on building your career, not stressing about paperwork.

What You Should Do Before 2026

Register for a TIN (Tax Identification Number) if you don’t have one yet.

Keep detailed records of all your income and expenses Myaza helps with this.

Understand your tax bracket so you can plan your finances accordingly.

Convert and calculate your total yearly income in naira using official rates.

Consult a tax professional to make sure you’re fully compliant when the law kicks in.

The Bottom Line

Nigeria’s new tax era is here, and it’s digital.

If you’re earning in foreign currency, you’ll need to report it, but with tools like Myaza, you can do that smartly, clearly, and without stress.

Because Myaza isn’t just about sending and receiving money. It’s about helping Africans live borderless lives while staying compliant and confident.

You’ve worked hard for your money. Let Myaza help you keep it clean, safe, and in your control.