The Silent Money Drainers You’re Overlooking: How Everyday Habits Are Costing You More Than You Think

Ever feel like your money just disappears before you even get a chance to spend it? You're not alone. Most people are unaware of the silent money drainers in their lives, those seemingly small habits that slowly chip away at your savings without you even realizing it.

It's not just about big purchases; sometimes, it's the everyday choices that have the most significant financial impact over time. Subscriptions you forgot to cancel, unnecessary bank fees, or even impulse buys can be silent culprits that cost you far more than you notice in the moment.

Let's take a deeper dive into these often-overlooked money drainers and how you can reclaim your financial control.

1. Subscription Overload

We live in a subscription-based economy—streaming services, gym memberships, and even apps. While $9.99 a month might seem small, multiply that by a few forgotten subscriptions, and you've got a significant sum slipping away each year. Services you haven't used in months could still be quietly billing you.

2. Bank Fees That Add Up

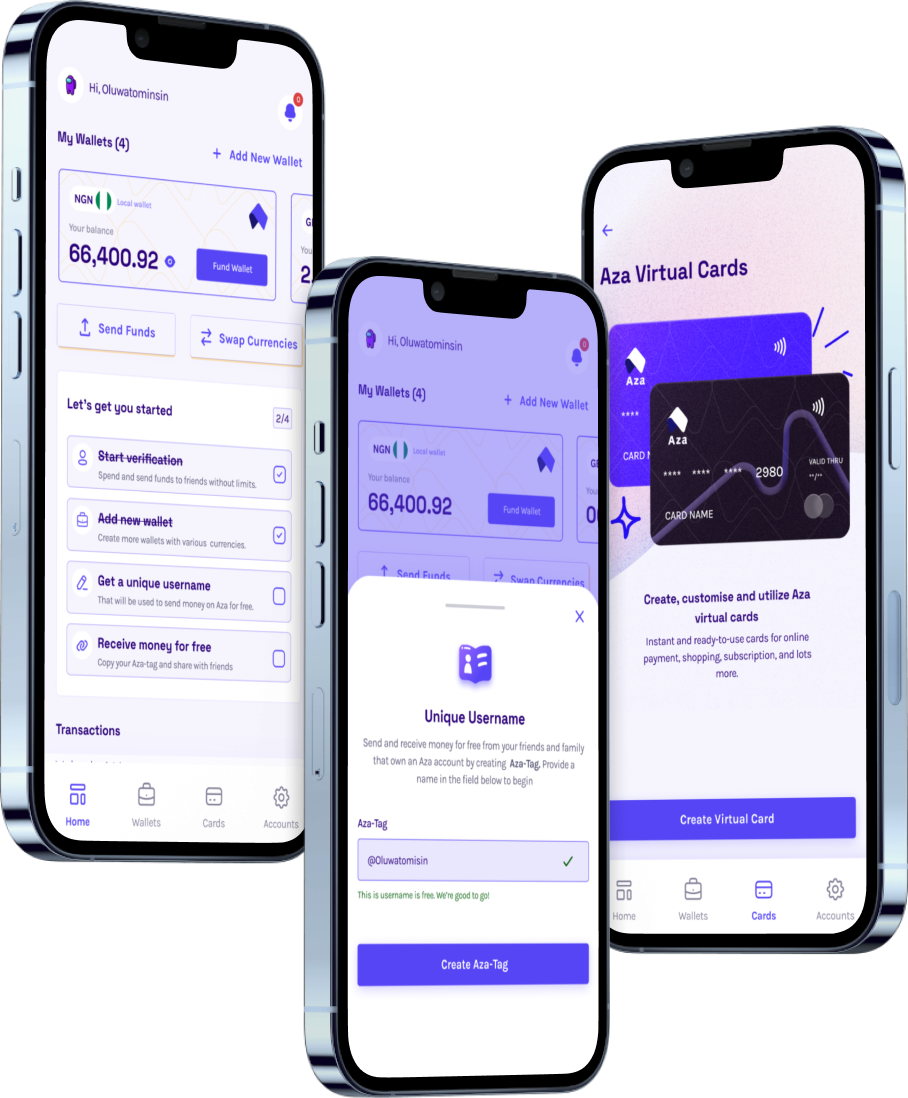

Banks are notorious for sneaky fees—overdraft fees, maintenance fees, ATM fees. Even if each fee seems small, they accumulate over time. Switching to a bank or fintech service that offers zero-fee banking can save you hundreds, if not thousands, in the long run. Myaza, for example, offers virtual cards with no hidden fees, helping you avoid unnecessary drains on your account.

3. Impulse Buying and Emotional Spending

We’ve all been there: a bad day turns into a shopping spree, or an enticing sale lures you into buying something you don't need. It may not feel like a lot in the moment, but these spontaneous purchases add up fast. One of the best ways to control impulse buying is to stick to a budget and avoid spending when you’re feeling emotional.

4. Neglecting Cashback and Rewards Programs

While you're out there spending, you could be earning money back through cashback programs or reward points. Failing to take advantage of these opportunities is like leaving money on the table. With services like Myaza’s virtual card, you can easily track and redeem rewards, ensuring that every dollar you spend works for you.

5. Failing to Automate Your Savings

Sometimes, it’s not about spending more but missing opportunities to save. Automating your savings by setting aside a portion of your income before you can even touch it is a simple way to build financial security without having to think about it.

Taking Control

The first step to overcoming these money drainers is awareness. Once you’ve identified where your money is going, it becomes easier to make adjustments. Whether it’s canceling unused subscriptions, switching to a no-fee bank account like Myaza’s, or simply becoming more mindful of your spending habits, small changes can make a big difference over time.

So, are you ready to reclaim your finances from these silent drainers? Start paying attention to the little things, and you’ll see how much further your money can go.