Smart Spending—How to Make Your Money Work Harder for You

It’s not just about earning money—it’s about making every naira, dollar, or euro count.

We all have that moment when we check our accounts and feel like our money just evaporated into thin air.

You look at your statement, wondering where it all went, and start to question your spending decisions. But what if it’s not about how much you spend, but how you spend it?

The reality is that spending isn’t just an activity; it’s a skill that can be honed.

With the right tools and strategies, you can turn every purchase, every transfer, and every subscription into an opportunity to maximize your money’s value. That’s where smart spending comes in.

What is Smart Spending All About?

Smart spending is about being intentional with your money. It’s about making the most out of every transaction and knowing that your financial tool is doing all the heavy lifting for you.

You should be able to make payments and transfers, save money, and invest in opportunities that grow your wealth without breaking a sweat.

Sounds ideal, right? Well, it’s absolutely achievable.

Here’s what you should look out for when aiming to make your money work harder for you:

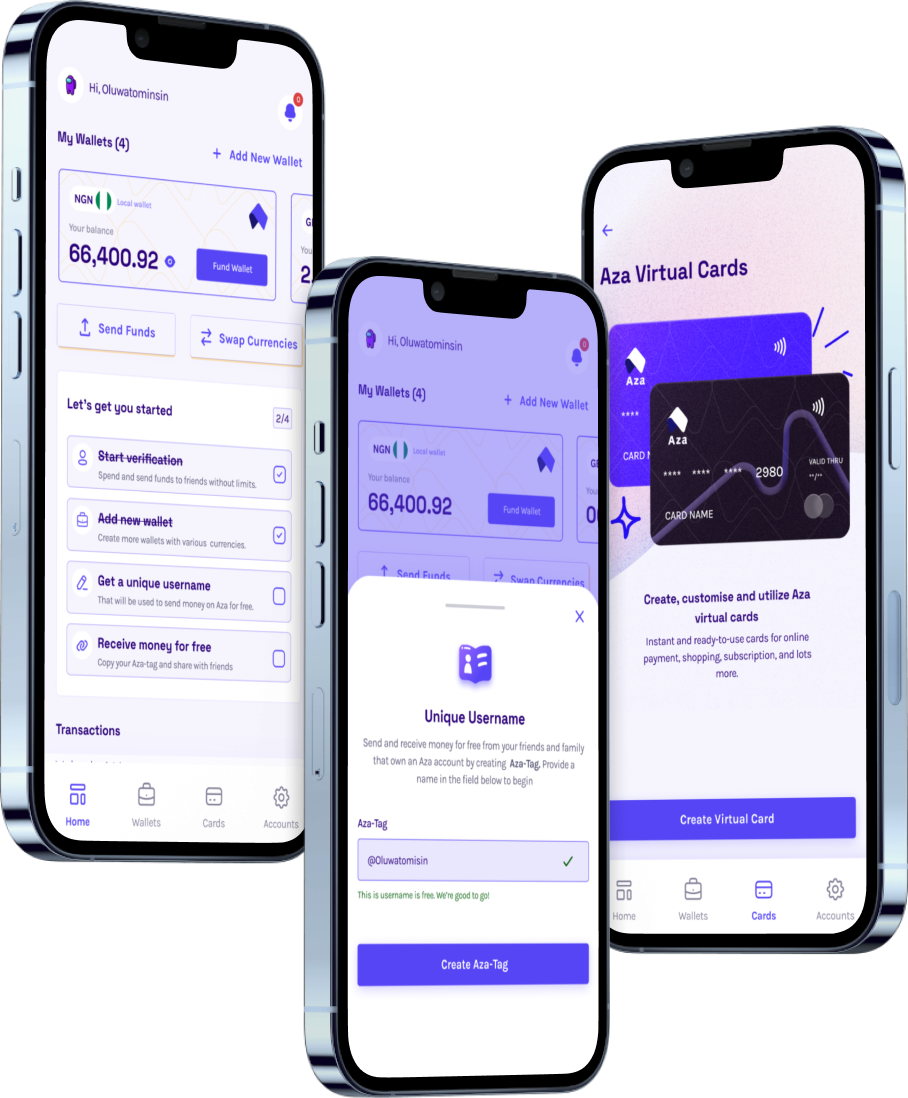

The Right Card for Global Spending: Ever tried making a purchase on Amazon, paying for a flight ticket, or subscribing to an international service, only to face repeated declines or ridiculous fees? It’s frustrating.

But what’s more annoying is knowing that there are better options out there—cards that actually work where you need them to, and offer the best rates for your transactions.

Look for a card that is globally accepted and backed by a network you can trust. This ensures you can shop from your favorite international stores without restrictions.

Affordable, Hassle-Free Transfers: Sending money shouldn’t feel like pulling teeth. You want fast, reliable transfers with zero hidden charges and the best rates out there.

Finding a solution that allows you to send and receive money across borders without the usual headaches will save you both time and money. And the best part? It’s all possible with the right platform.

Savings That Match Your Goals: Saving isn’t about stashing money in a vault. It’s about putting your money in a place where it can grow and work for you. Smart savings plans offer high returns, flexibility, and easy access.

Look for platforms that provide target savings, automated deposits, and interest rates that make your efforts worthwhile.

A Platform That Prioritizes Security: Your money’s safety should be non-negotiable. Go for solutions that prioritize secure transactions, protecting your funds with cutting-edge technology. After all, peace of mind is priceless.

Conclusion: Smart spending is the gateway to financial freedom. It’s more than just avoiding fees or getting the best deals; it’s about having control and flexibility in how you use your money.

With the right tools, you can make every penny work harder, achieve your financial goals faster, and make transactions smoother than ever. Whether it’s with a reliable card, secure transfers, or a robust savings plan, there’s a smarter way to manage your money.

Don’t let your money slip through your fingers—take charge and make every cent count.