How to Choose the Right Virtual Card for Your Needs

In today’s digital-first world, virtual cards have become essential for making secure and convenient transactions online. Whether you’re shopping on your favorite e-commerce site, subscribing to services, or even paying for business expenses, virtual cards offer a safe and efficient alternative to traditional physical cards. But with so many options available, how do you choose the right one for your needs?

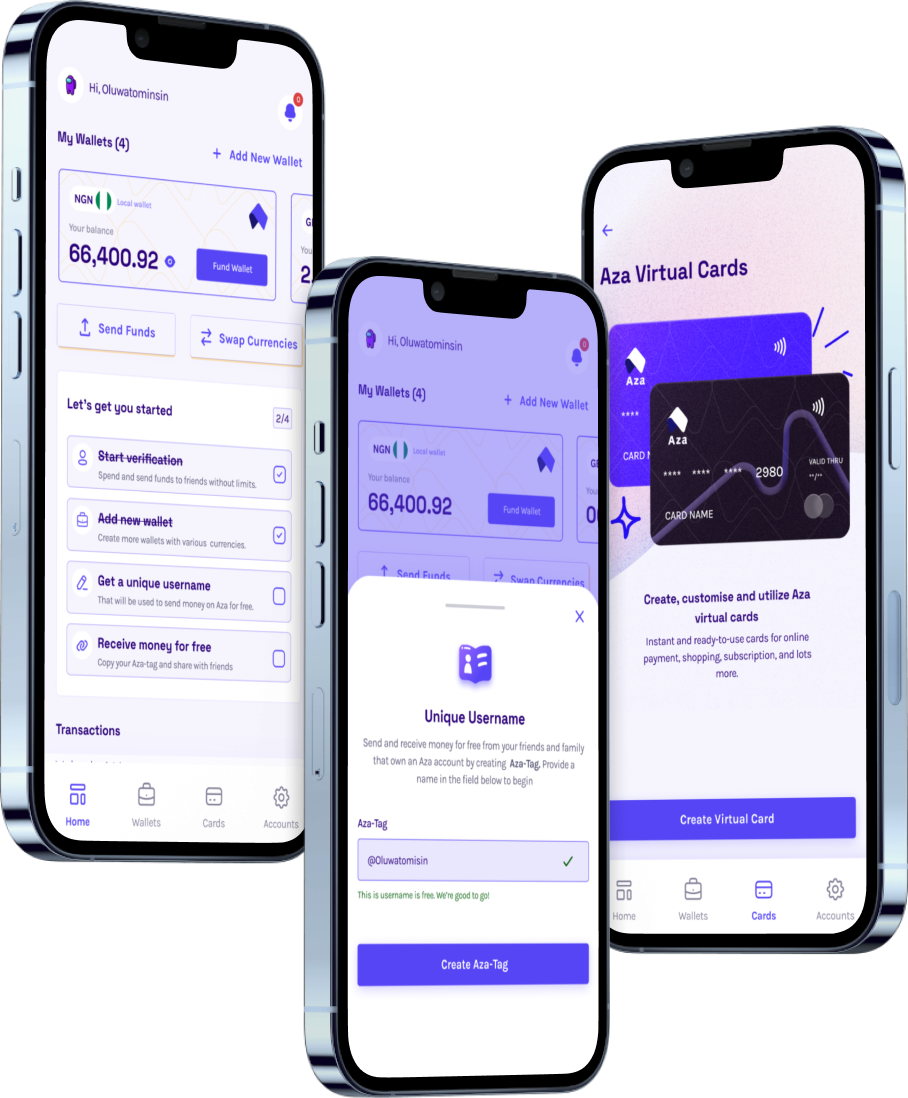

In this guide, we’ll walk you through the key factors to consider when selecting a virtual card, and why Myaza’s $1 virtual card might be the perfect fit for you.

1. Understand the Basics: What is a Virtual Card?

A virtual card is a digital version of your debit or credit card. Instead of receiving a physical piece of plastic, you get a virtual card number that you can use for online and in-app transactions. This card works exactly like a regular card but offers enhanced security and flexibility, as it can be used for multiple transactions or even disposed of after one-time use, depending on your preferences.

Why People Prefer Virtual Cards:

Enhanced Security: Virtual cards can be easily generated and replaced if compromised, protecting your main bank account or credit line.

Convenience: You can access your virtual card instantly, without waiting for mail deliveries or worrying about losing a physical card.

Control Over Spending: Many virtual cards allow you to set specific spending limits, offering better control over your finances.

2. Key Factors to Consider When Choosing a Virtual Card

While virtual cards offer great flexibility, not all of them are created equal. Here are a few factors you should keep in mind when selecting one:

a) Transaction Fees:

Some virtual cards come with hidden fees—whether it’s for issuance, reloading, or international transactions. It’s essential to review the fee structure before choosing a card, especially if you plan to use it frequently or for cross-border purchases.

With Myaza’s $1 virtual card, users enjoy transparent pricing and low fees, making it one of the most affordable options on the market. For just $1, you can get your virtual dollar card and start making transactions in minutes, without worrying about excessive charges eating into your funds.

b) Compatibility and Flexibility:

Before selecting a virtual card, ensure that it’s compatible with your desired platforms. For instance, some cards may not work on certain websites or with specific payment processors like PayPal. The right card should offer you flexibility, whether you’re shopping on international websites or subscribing to services that require recurring payments.

Myaza’s virtual card is compatible with major global platforms, including e-commerce giants and popular streaming services. Plus, you can link it to your PayPal account for seamless transactions.

c) Security Features:

Security should always be a top priority when dealing with online transactions. Look for virtual cards that offer advanced security features such as two-factor authentication (2FA), fraud detection, and the ability to freeze or deactivate the card instantly.

Myaza ensures that your transactions are protected with state-of-the-art encryption, fraud monitoring, and instant card control, so you can shop and pay with peace of mind.

d) Customization Options:

Some virtual cards allow users to set limits on spending or restrict the card to specific types of transactions. This feature can be particularly useful for budgeting or for businesses managing employee expenses. The ability to generate multiple virtual cards for different purposes can also be beneficial.

Myaza’s platform offers users flexibility by letting them create and manage virtual cards tailored to their needs. Whether you need a one-time-use card for a specific purchase or a card with a monthly spending limit, Myaza’s virtual card options provide unmatched customization.

e) Ease of Use and Access:

How easy is it to get a virtual card and start using it? The right virtual card should offer a seamless onboarding process, from registration to activation, without unnecessary hurdles or long wait times.

With Myaza, you can sign up, create a virtual card, and start making transactions in just minutes. Our user-friendly app interface ensures that you can manage all your cards and track your spending effortlessly, wherever you are.

3. Why Myaza’s $1 Virtual Card is the Best Choice for You

After considering all these factors, Myaza’s $1 virtual card stands out as the best option for users who want affordability, security, and flexibility in their online transactions. Whether you’re a frequent online shopper, a business owner, or someone looking to manage your subscriptions more effectively, Myaza’s virtual card offers everything you need.

Key Features of Myaza’s Virtual Card:

Low Cost: For just $1, you can access a virtual dollar card and start making global payments.

Compatibility: Use it across major platforms, including PayPal, Amazon, Netflix, and more.

Top-Notch Security: Your transactions are protected with industry-leading security features, including encryption and fraud monitoring.

Control & Customization: Set spending limits, create multiple cards, and freeze or delete them whenever you want.

Instant Access: Get your card and start using it within minutes.

4. When to Use a Virtual Card

Virtual cards are a versatile tool that can be used in a variety of situations. Here are some ideal scenarios:

a) Online Shopping:

Whether you’re buying products from your favorite e-commerce store or a niche online retailer, virtual cards offer a safe and secure way to complete your transactions. With the rise of online shopping, virtual cards help minimize the risk of fraud.

b) Subscription Services:

From streaming platforms like Netflix to cloud storage services, many online services require recurring payments. Using a virtual card for subscriptions adds an extra layer of security, as you can easily control your payments and prevent unauthorized charges.

c) International Purchases:

For individuals or businesses making international transactions, a virtual dollar card is a must-have. It eliminates the complexities of currency conversion and foreign transaction fees. With Myaza’s $1 virtual card, you can enjoy smooth, hassle-free cross-border transactions.

Conclusion: Future-Proof Your Finances with Myaza

As virtual cards continue to gain popularity, they are becoming an indispensable tool for secure and convenient digital payments. Whether you’re managing personal finances or running a business, choosing the right virtual card can make all the difference in terms of security, flexibility, and cost-effectiveness.

With Myaza’s $1 virtual card, you get the perfect balance of affordability, functionality, and security. It’s a simple, cost-effective solution that empowers you to take control of your online payments—whether at home or abroad.

Ready to get started? Explore Myaza’s $1 virtual card today and experience the future of digital payments for yourself.