How to Choose a Cross-Border Payments App You Can Actually Trust

Let’s be honest. Moving money across African borders can feel like a full-time job. You are either battling endless fees, praying your card does not decline, or waiting three business days for a transaction that should have been instant.

Whether you are a freelancer in Lagos, a startup founder in Nairobi, or sending money to family in Ghana, one thing is clear. You deserve better.

With so many payment platforms promising speed and convenience, how do you know which one to trust? Let us break it down the Myaza way. Simple, real, and straight to the point.

Why People Rely on Cross-Border Platforms

The world is more connected than ever. We buy, work, and earn from everywhere, yet traditional banks still move like it is 1998. That is where cross-border payment platforms come in.

People use them for:

E-commerce: Buying or selling globally without worrying about currency drama.

Remittances: Sending money home quickly and without the heartbreak of high fees.

Trade: Paying international suppliers or partners without chasing confirmations.

Travel: Swiping your card abroad without hearing “transaction declined.”

Cross-border tools exist to make life easier, but not all of them deliver on that promise.

The Common Problems with Cross-Border Payments

Let us talk about the pain points that nobody warns you about.

1. Hidden fees everywhere One minute you are sending 100 dollars. The next moment, your friend receives only 88. Between conversion rates, processing charges, and extra bank fees, your money seems to disappear before it lands.

2. Slow transfers Why are some platforms still taking days to move money? In a world of instant messaging and same-day delivery, that simply should not happen anymore.

3. Too much paperwork and regulation Every country has its own playbook. The result is delays, rejections, and endless “kindly verify again” messages. Exhausting, right?

4. No transparency Sometimes you do not even know where your money is. Did it arrive? Is it still pending? Or is it stuck somewhere in between? That kind of uncertainty breaks trust.

5. Security risks From phishing links to sketchy routes, cross-border payments can attract fraudsters easily. If your platform is not secure, your money and data are at risk.

What to Look For in a Cross-Border Payment Platform

Before you send that next transfer, here is your checklist.

1. Smooth experience If it feels like rocket science to make a payment, something is wrong. Look for a platform that is fast, simple, and easy to understand.

2. Strong security Your money deserves more than empty promises. Choose platforms that offer biometric login, encryption, and clear transaction tracking.

3. Real speed Money should move as fast as you do. If a platform cannot process payments instantly or close to it, it is not built for your lifestyle.

4. Honest pricing No hidden costs. No shady exchange rates. You should always know exactly how much is leaving your wallet and how much will arrive.

5. Multi-currency freedom Your work, hustle, and life are global. You need a platform that supports multiple currencies such as naira, cedi, shilling, rand, and dollar without unnecessary conversion stress.

Why Myaza Checks All the Boxes

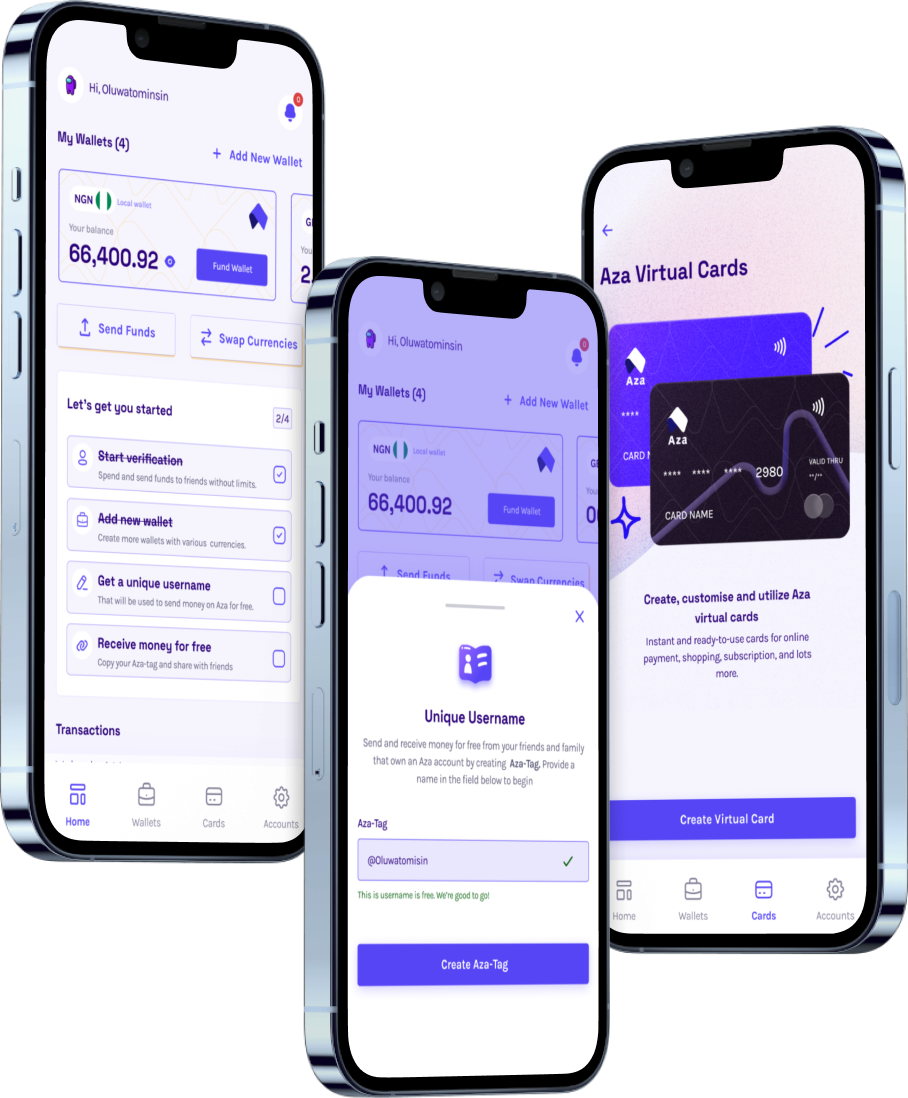

Myaza was built for Africans who live, work, and earn across borders. It is not just another fintech app. It is your borderless financial partner.

Here is what makes Myaza stand out:

1. Real multi-currency wallets Hold, send, and swap across naira, cedi, shilling, rand, dollar, and even stablecoins such as USDT and USDC. Everything happens in one simple app.

2. Instant transfers Payments land immediately, not in “a few business days.” Whether you are paying a client or shopping online, Myaza moves at your speed.

3. Transparent rates What you see is what you get. Myaza gives you real-time currency rates and clear fees upfront. No hidden deductions, no surprises.

4. Strong protection Biometric login, device tracking, and advanced fraud prevention keep your money and data safe. You remain in control of every transaction.

5. Designed for real people From freelancers and crypto traders to small business owners and remote workers, Myaza is made to make your money move as fast as your dreams do.

The Bottom Line

Cross-border payments should not feel like an exam. You work too hard for your money to get trapped between banks, apps, and excuses.

With Myaza, you get simplicity, speed, and trust. That is the way modern money should work.

Ready to skip the stress? Download Myaza today and experience borderless payments built for Africa.

No limits. No delays. Just freedom to move your money, your way.