How to Avoid Ponzi Schemes Like CBEX and Grow Your Savings in Dollars

In April 2025, the digital asset world shook with the sudden collapse of CBEX—a platform that had built a glowing reputation in Nigeria and Kenya. It promised the impossible: 100% returns in just 30 days. For many, especially in struggling economies, this wasn’t just tempting—it felt like salvation.

Over 600,000 hopeful investors poured their life savings, emergency funds, and even borrowed money into the scheme. In total, CBEX reportedly siphoned off more than $800 million before vanishing into thin air.

What made it more painful wasn’t just the loss—it was how real everything seemed. CBEX had the look of a legitimate financial institution: well-designed websites, professionally branded materials, glowing “testimonials,” and even AI-powered trading dashboards that gave the illusion of real-time earnings. But it was all smoke and mirrors.

And when the music stopped, many were left devastated, confused, and broke.

Why Do We Keep Falling for These Schemes?

It's easy to think, "I would never fall for that." But when you're stuck in a cycle of financial struggle—watching the value of your local currency drop, facing job insecurity, and seeing prices rise—it’s natural to dream of a shortcut. That dream makes us vulnerable.

Ponzi schemes exploit this vulnerability with psychological precision. They don’t just offer high returns—they tell a story. A story of hope, transformation, and finally escaping the rat race. And when that story is backed by photos, voice notes, influencers, and people who “cashed out,” it's hard not to believe.

“If it worked for them, maybe it’ll work for me too.”

Before you know it, you’re in.

Spotting the Red Flags Before It's Too Late

The truth is, most Ponzi schemes share common traits. If you know what to look for, you can avoid them.

Here are the major red flags:

Unrealistic Promises: Any platform promising unusually high or guaranteed returns—especially in a short time frame—is likely fraudulent. No legitimate investment can guarantee 100% profit in 30 days.

Lack of Clarity: If they can't explain how your money grows in plain English—or they use too much financial jargon to confuse you—that's a red flag.

Recruitment Over Results: If you're pressured to invite friends or earn more by bringing in others, you’re likely dealing with a pyramid scheme in disguise.

Overuse of Buzzwords: Terms like “AI-driven,” “blockchain-powered,” or “quantum trading” are often thrown around without proof of actual tech. Always verify.

No Registered Entity or Regulation: If the business isn’t licensed or doesn’t disclose its legal standing, stay far away.

Limited or No Customer Support: If you can’t reach a real person for help—or only get responses via Telegram or WhatsApp—be wary.

The truth is, there’s no shortcut to wealth. But there are smart ways to grow your money over time—safely.

One of the most powerful strategies is Saving in dollars.

Here’s why:

Stability: Unlike the naira or other local currencies, the US dollar is globally stable and less prone to inflation.

Protection: Your money retains more value in dollars, especially during economic downturns or currency devaluation.

Accessibility: Dollar savings give you the power to shop online, invest globally, and stay financially flexible.

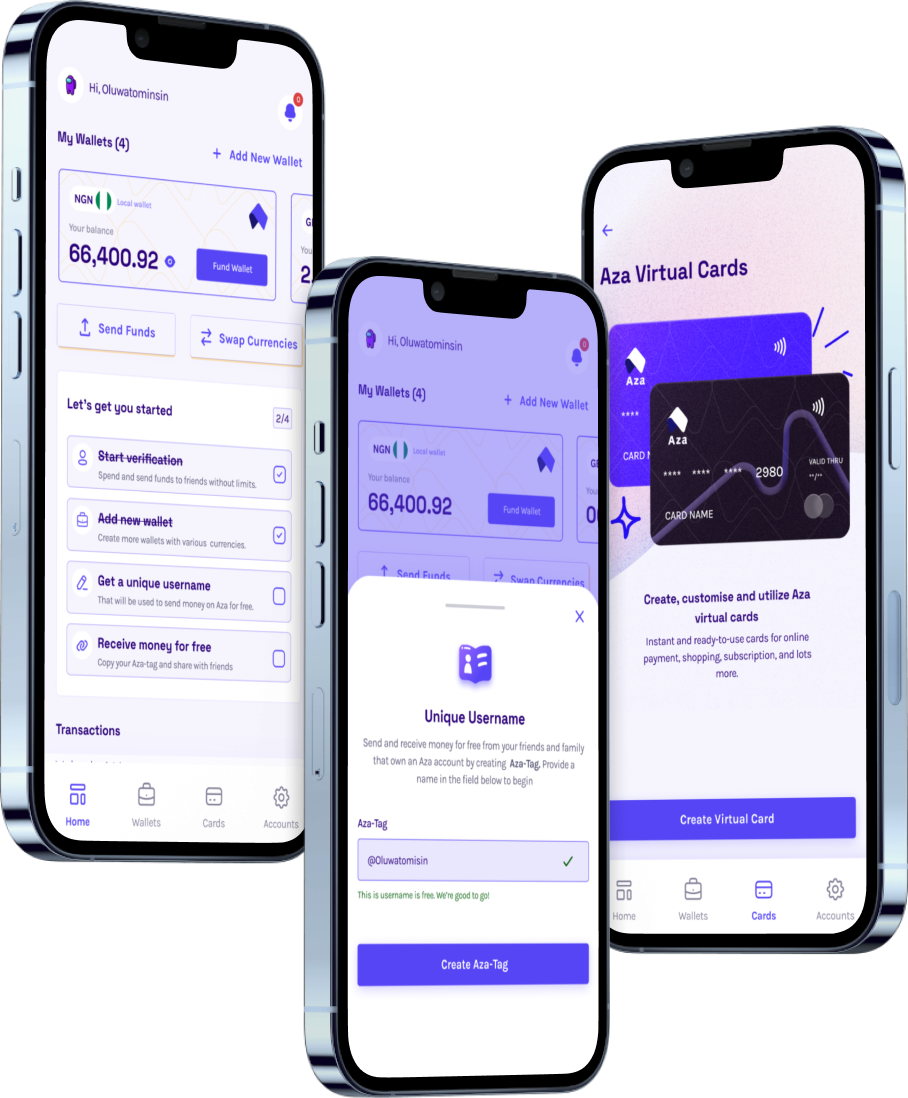

Use a Dollar Saving App Like Myaza

This is where Myaza comes in. Designed with you in mind, Myaza helps you save smarter by giving you access to the global economy—without the headache.

With Myaza, you can:

Save in USD: Say goodbye to waking up to a devalued currency. Your savings are stored in a more reliable currency.

Spend Internationally: Use your virtual dollar card to shop on Amazon, pay for courses, subscribe to services, and more—no restrictions, no tricks.

Earn While You Save: With competitive interest rates, your money doesn’t just sit—it works for you.

Stay Secure: Myaza operates with top-notch security protocols, so your funds and data are always protected.

Don’t Gamble with Your Future, Secure It

The internet is full of “opportunities,” but not all of them are real. The CBEX saga is just one of many examples. Every year, thousands of people lose everything because they took a gamble masked as an investment.

You deserve better. You deserve financial freedom—but not the kind that comes with sleepless nights and empty promises.

Make smarter choices. Choose platforms that prioritize transparency, security, and real growth.

With Myaza, you’re not just saving—you’re winning.